This roadmap provides a comparison of IFRS and US GAAP—two of the most widely used accounting standards in the world—and the most significant ways they diverge. Here’s a look at generally accepted accounting principles vs. International Financial Reporting Standards as well as how SAP products can potentially help users comply with international financial reporting rules.

Developed by the International Accounting Standards Board , IFRS is a set of accounting standards and rules that companies around the world use to prepare their financial statements. IFRS Vs GAAP is the most debatable topic in accounting where the former is defined as the financial reporting method having universal applicability while the latter are the set of guidelines made for financial accounting. Since past few years, IFRS has gained significant importance, due to which over hundred countries of the world have adopted IFRS as the standard for accounting.

Pros And Cons Of Ifrs

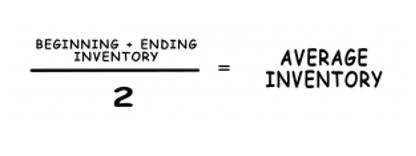

The use of LIFO methodology of costing is not allowed by the IFRS while the use of LIFO costing methodology is allowed by the US GAAP. Single-step format – which factors in all the expenses and categorizes them by function and multiple-step format – to show the gross profit, the expense of sales is deducted from the sales along with other income and expenses. The data management vendor has secured $278 million in financing since December 2020 and plans to use the new funds to fuel … The analytics vendor’s product leaders all remain in place, so while it will have a new company leader, its product development … The open source online analytical transaction processing DBaaS startup takes a different approach to accelerate queries as it … With its Cerner acquisition, Oracle sets its sights on creating a national, anonymized patient database — a road filled with …

Member firms of the KPMG network of independent firms are affiliated with KPMG International. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.

Difference Between Us Gaap Vs Ifrs

Cromwell holds a bachelor’s and master’s degree in accounting, as well as a Juris Doctor. The US Financial Accounting Standards Board that endorses GAAP , and the International Accounting Standards Board that defines IFRS have both been working steadily towards convergence for a few years now. The convergence process is designed to figure out the significant differences between IFRS and US GAAP that need improvement. However, some differences will still continue to exist between the two systems. More than ever, they are accountable to growing numbers of active stakeholders – including governments and regulators across the world – for their approach to environmental, social and governance issues. GAAP prefers using the LIFO as an inventory method for estimating inventory. IFRS, however, does not approve this method as LIFO does not reveal the actual flow of inventory in most cases, resulting in unusually low-income levels.

The other distinction between IFRS and GAAP is how they assess the accounting processes – i.e., whether they are based on fixed rules or principles that allow some space for interpretations. Under GAAP, the accounting process is prescribed highly specific rules and procedures, offering little room for interpretation. The measures are devised as a way of preventing opportunistic entities from creating exceptions to maximize their profits. On the other hand, the Generally Accepted Accounting Principles are created by the Financial Accounting Standards Board to guide public companies in the United States when compiling their annual financial statements. The Canadian Generally Accepted Accounting Principles were a set of standards, guidelines, and procedures dealing with accounting. If you need to borrow money to cover seasonal cash flow fluctuations, a business line of credit, rather than a term loan, provides the flexibility you likely need. The most comprehensive package on the market today for investment banking, private equity, hedge funds, and other finance roles.

U S Gaap Vs Ifrs

Earning-per-Share — Under IFRS, the earning-per-share calculation does not average the individual interim period calculations, whereas under GAAP the computation averages the individual interim period incremental shares. Regardless of whether a company uses IFRS or GAAP, the intent of each is for there to be more transparency on the strength and position of companies so GAAP vs IFRS that investors can compare one to another more easily. Currently, the IFRS Foundation is monitoring the use of the standards in more than 160 jurisdictions, including Canada, Australia, Mexico, and much of Europe. Even though US companies use GAAP, IFRS is permitted for US listings by foreign companies. More than 500 foreign SEC registrants use IFRS in their US filings.

This was eventually exposed in 2020, in which TSAI’s revenue from software license fees saw an immediate 16.1% fall post-adoption of SOP 97-2. Under GAAP, companies are allowed to supplement their earning report with non-GAAP measures.

Us Gaap Vs Ifrs In Valuation And Financial Modeling 25:

Anderson is CPA, doctor of accounting, and an accounting and finance professor who has been working in the accounting and finance industries for more than 20 years. Her expertise covers a wide range of accounting, corporate finance, taxes, lending, and personal finance areas.

SAP users can pursue different strategies, including taking a multi-ledger approach, to comply with financial reporting standards. The new edition(PDF 2.2 MB) of our comparison of IFRS Standards and US GAAP highlights the key differences between the two frameworks, based on 2021 calendar year ends. If you’re a preparer, it may help you to identify areas to emphasise in your financial statements; if you’re a user, it may help you spot areas to focus on in your dialogue with preparers. Under US GAAP, fixed assets such as property, plant and equipment are valued using the cost model i.e., the historical value of the asset less any accumulated depreciation. IFRS allows another model – the revaluation model – which is based on fair value on the date of evaluation, less any subsequent accumulated depreciation and impairment losses. GAAP prescribes that interest paid and interest received should be classified as operating activities, while international standards are a bit more flexible. Under IFRS, a firm can choose its own policy for classifying interest based on what it considers to be appropriate.

Discover what makes RSM the first choice advisor to middle market leaders, globally. Development Cost is treated as an expense in GAAP, while in IFRS, the cost is capitalised provided the specified conditions are met. IFRS is the standard followed by the European Union and some parts of Asia and South America. IFRS offers several benefits over the Indian GAAP. IFRS improves transparency in accounting system, it is globally accepted, and also allows exercise of professional judgment.

The group company’s statements must roll up numbers from each subsidiary based on the accounting standards for the consolidated report. For example, the organization must first render the financial statements for each of the four companies in U.S. The IFRS is a set of standards developed by the International Accounting Standards Board .

Ifrs Vs Gaap: An Overview

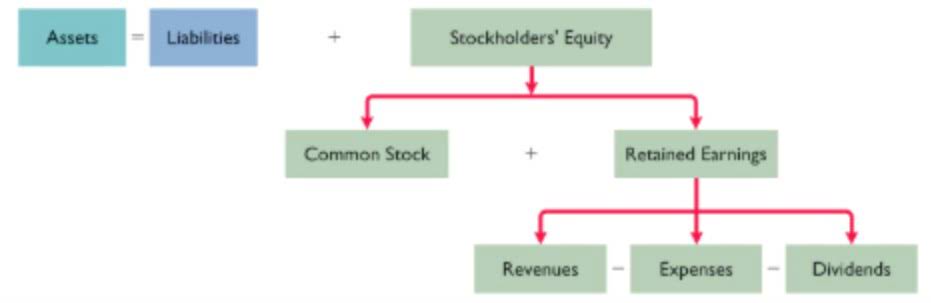

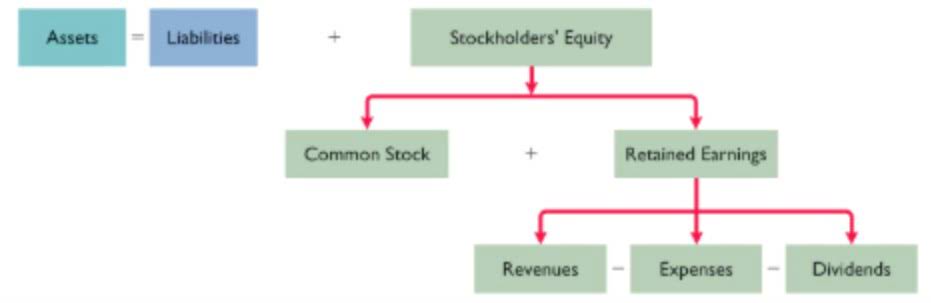

When preparing financial statements based on the GAAP accounting standards, liabilities are classified into either current or non-current liabilities, depending on the duration allotted for the company to repay the debts. GAAP is a common set of generally accepted accounting principles, standards, and procedures. U.S. public companies must follow GAAP for their financial statements. The growing acceptance of International Financial Reporting Standards as a basis for U.S. financial reporting represents a fundamental change for the U.S. accounting profession. Today, approximately 113 countries require or allow the use of IFRS for the preparation of financial statements by publicly held companies. In the United States, the Securities and Exchange Commission has been taking steps to set a date to allow U.S. public companies to use IFRS,and perhaps make its adoption mandatory.

- This set of guidelines is set by the Financial Accounting Standards Board and adhered to by most US companies.

- On the other hand, US GAAP generally requires immediate expensing of both research and development expenditures, although some exceptions exist.

- Work is being done to converge GAAP and IFRS, but the process has been slow going.

- Capitalized CostsCapitalization cost is an expense to acquire an asset that the company will use for their business; such costs are recorded in the company’s balance sheet at the year-end.

- Extraordinary ItemsExtraordinary Items refer to those events which are considered to be unusual by the company as they are infrequent in nature.

In-depth analysis, examples and insights to give you an advantage in understanding the requirements and implications of financial reporting issues. Under GAAP, the company charges all the development costs to expenses as and when the company incurs them. IFRS, however, allows capitalization and amortization of some of these costs over multiple periods. GAAP’s treatment might be conservative, while IFRS treatment might be too aggressive in allowing deferment of costs that should have been charged to the expenses at the time when they are incurred.

If the software will only be used internally, GAAP requires capitalization only during the development stage. Both standards allow for the recognition of impairment losses on long-lived assets when the market value of an asset declines. When conditions change, IFRS allows impairment losses to be reversed for all types of assets except goodwill. GAAP takes a more conservative approach and prohibits reversals of impairment losses for all types of assets. We live in an increasingly global economy, so it’s important for business owners and accounting professionals to be aware of the differences between the two predominant accounting methods used around the world.

In September 1999, the FASB published its second edition of an IASC-U.S. Comparison Project, a comprehensive comparative study of IASC standards https://www.bookstime.com/ and GAAP. This 500-page report included comparative analyses of each of the IASC’s “core standards” to their GAAP counterparts.

If splitting your payment into 2 transactions, a minimum payment of $350 is required for the first transaction. Matt Gavin is a member of the marketing team at Harvard Business School Online. Prior to returning to his home state of Massachusetts and joining HBS Online, he lived in North Carolina, where he held roles in news and content marketing.

The issuing organizations of the two are continuously working on their convergence. Reporting differences with respect to the process and amount by which we value an item on the financial statements also applies to inventory, fixed assets and intangible assets. GAAP is more conservative, while IFRS encourages reporting financial results that align with current realities. For example, GAAP requires recording fixed assets at their historical cost, then regularly depreciating the fixed assets.

Ifrs Vs Us Gaap Infographics

GAAP is the accounting standard used in the US, while IFRS is the accounting standard used in over 110 countries around the world. GAAP is considered a more “rules based” system of accounting, while IFRS is more “principles based.” The U.S. Securities and Exchange Commission is looking to switch to IFRS by 2015. The two main sets of accounting standards followed by businesses are GAAP and IFRS.

Famosos2 semanas ago

Famosos2 semanas ago

Famosos2 semanas ago

Famosos2 semanas ago

Entretenimento4 dias ago

Entretenimento4 dias ago

Moda2 semanas ago

Moda2 semanas ago

Música e Show2 semanas ago

Música e Show2 semanas ago

Moda2 semanas ago

Moda2 semanas ago

Moda2 semanas ago

Moda2 semanas ago

Música e Show2 semanas ago

Música e Show2 semanas ago